A Market That Went from Zero to Sprint

Ontario’s long-awaited Market Renewal Program (MRP) launched on May 1, 2025, replacing the two-schedule system with 5-minute locational marginal prices (LMPs) and a financially binding Day-Ahead Market (DAM)— now sets the baseline for physical dispatches and settlements. The inaugural DAM cleared on May 3, and by May 4 the IESO declared the renewed market cycle complete.

Early data proves the nodal era is already rewriting risk:

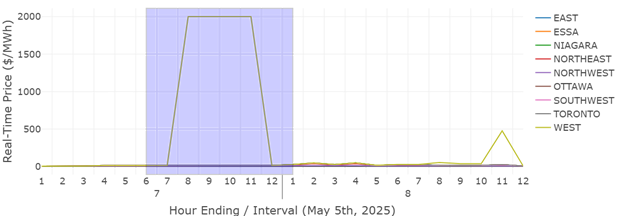

- May 5 price spike. A 15-minute bottleneck in the West zone sent real-time power prices to the $2,000/MWh cap, while nearby zones stayed around $15/MWh.

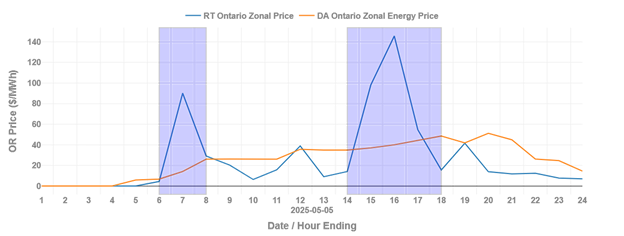

- Big gap between day-ahead and real-time. On the first full trading day, the Day-Ahead Market averaged $2/MWh, but the real-time price averaged $13/MWh—and in one hour the difference was $100/MWh.

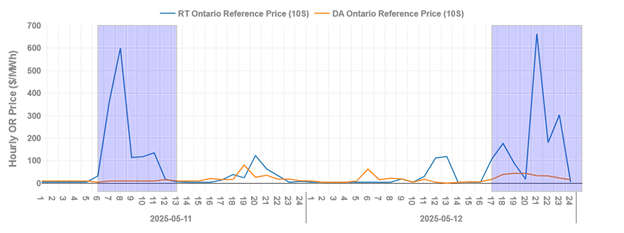

- Costly backup power. Payments for operating reserves (the system’s ‘insurance’ power) climbed to $600/MWh in the day-ahead market and $526/MWh in real time.

Ontario now trades with the volatility that the North-East markets see only on their toughest days.

When One Outage Rewrites the P&L

On the evening of May 12, a sudden shutdown at Bruce Power took 1,200 MW off the grid. Real-time prices in the Southwest shot above $900/MWh, even though the day-ahead market had been below $150/MWh—a gap of more than $750/MWh.

Put simply: in the first 11 days, anyone who didn’t actively manage their day-ahead position—or kept a unit offline when prices spiked—lost (or paid) more than $5,000 for every megawatt.

Costs Landing on Your Desk This Week

Preliminary settlement statements (your bill) under the new rules arrive May 15th. Three line items merit immediate scrutiny:

| Passive loads now pay (or earn) for day-ahead forecast errors. When West-zone LMPs hit $2 000, a 10 MW error cost ~$20 000 in five minutes. | |

| Clear the DAM but miss real-time dispatch and the spread settles at the RT LMP. Outages and morning oversupply have already produced spreads > $750/MWh. | |

| Reserve premiums eclipsed energy margins in week 1. Verify you are credited for every MW delivered, especially if partially curtailed. |

MRP Early Insights

- Congestion equals cash. Location matters and areas in the Northwest and West routinely experience triple-digit congestion charges.

- Flexibility wins, avoid or capture costly price-volatility. Quick-start gas and dispatchable loads captured the $2,000/MWh intervals; baseload hydro and wind in the Northwest cleared –$100/MWh for 36 straight hours.

- 02:00-05:00 is the new bargain window. Surplus baseload >4 GW pushed several nodes to ~$0/MWh.

- Settlement accuracy remains a wildcard. With 250+ new charge types, a 1% error may create significant deviations for Class A loads or Power Producers on your IESO bills.

How Rodan Helps You Stay Ahead

At Rodan we analyze the raw data in real time, 24/7 so that our clients don’t have to. This is invaluable to our clients by providing them with:

IESO Bill Verification

We manage daily data downloads, provide market pricing and ancillary estimates, track and reconcile variances, and validate all settlement statements. We also file notices of disagreement with the IESO daily to resolve any discrepancies, ensuring clients are billed accurately. With detailed monthly summaries and forecasts, we empower clients to make informed decisions with confidence.

Energy Market Optimization

Rodan’s 24/7 Real Time Operations Center (ROC) utilizes our proprietary and powerful Asset Optimization Software (AOS) optimizes your bids and offers to ensure our clients are always in the money.

MarketIQ™

In fast-moving energy markets, every second counts — and every trade impacts the bottom line. MarketIQ™ is the ultimate IESO energy market intelligence tool, built for power traders, generators, loads and financial institutions who need to react fast, capitalize on price swings, and maximize revenue. With real-time data, advanced forecasting, and actionable insights, you can fine-tune your positions, optimize generation, and outpace the market.

Each tool was designed for exactly the problems Ontario has delivered this month: ultra-fast price movement, opaque new settlement logic, and the need to reconcile both before cash changes hands.

Ready for What’s Next?

Ontario’s nodal era is moving fast—and the price of hesitation has already climbed into the thousands per megawatt. If your organization is still navigating the Market Renewal Program with pre-dispatch heuristics and spreadsheets, now is the moment to upgrade. Let Rodan Energy’s 24/7 analytics, optimization, and settlement-verification teams turn uncertainty into margin before the first preliminary statement lands, and the dispute clock starts ticking. Contact us today for a custom market impact analysis or to schedule a demo of how we can protect your bottom line under Ontario’s new MRP rules.